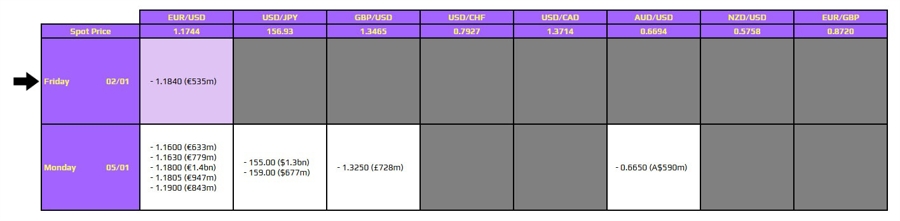

UPDATE: FX option expiries for January 2, 2026, are on the horizon as market activity is expected to surge after the holiday break. With many market players still away, today marks a lull in major expiries, but that is set to change as liquidity slowly returns next week.

As the New Year celebrations continue, traders are advised to prepare for a significant uptick in market movements. Although January 2 is quiet for now, the upcoming week will bring renewed focus on positioning flows for major currencies. This will be crucial for setting the tone for the year ahead.

In the precious metals sector, excitement is building as both gold and silver are experiencing notable rallies. Gold has surged by 1.5% to a price of $4,378, while silver has increased by 3.9%, currently trading at approximately $74.05. This resurgence is capturing the attention of investors eager to kick off 2026 with strong positions in these commodities.

As interest in FX options wanes today, the focus will undoubtedly shift towards how these developments impact market sentiment. With activity expected to ramp up soon, traders should keep an eye on how these fluctuations in precious metals will influence broader market dynamics.

The market will watch closely for any significant updates from sources like InvestingLive, which continues to provide vital information on these evolving trends. As 2026 unfolds, the implications of positioning flows and commodity movements will be critical for all investors navigating this transitional period.

Stay tuned for more updates as we monitor these developments closely. The New Year is shaping up to be pivotal for market strategies, and the first week will be one to watch.