UPDATE: A groundbreaking report by the Virginia-based research institute AidData reveals that China’s global lending has skyrocketed to an astonishing $2.1 trillion, reshaping the landscape of international finance and diplomacy. This urgent update emphasizes China’s ascension as the world’s largest creditor, outpacing its American counterpart in critical areas of influence.

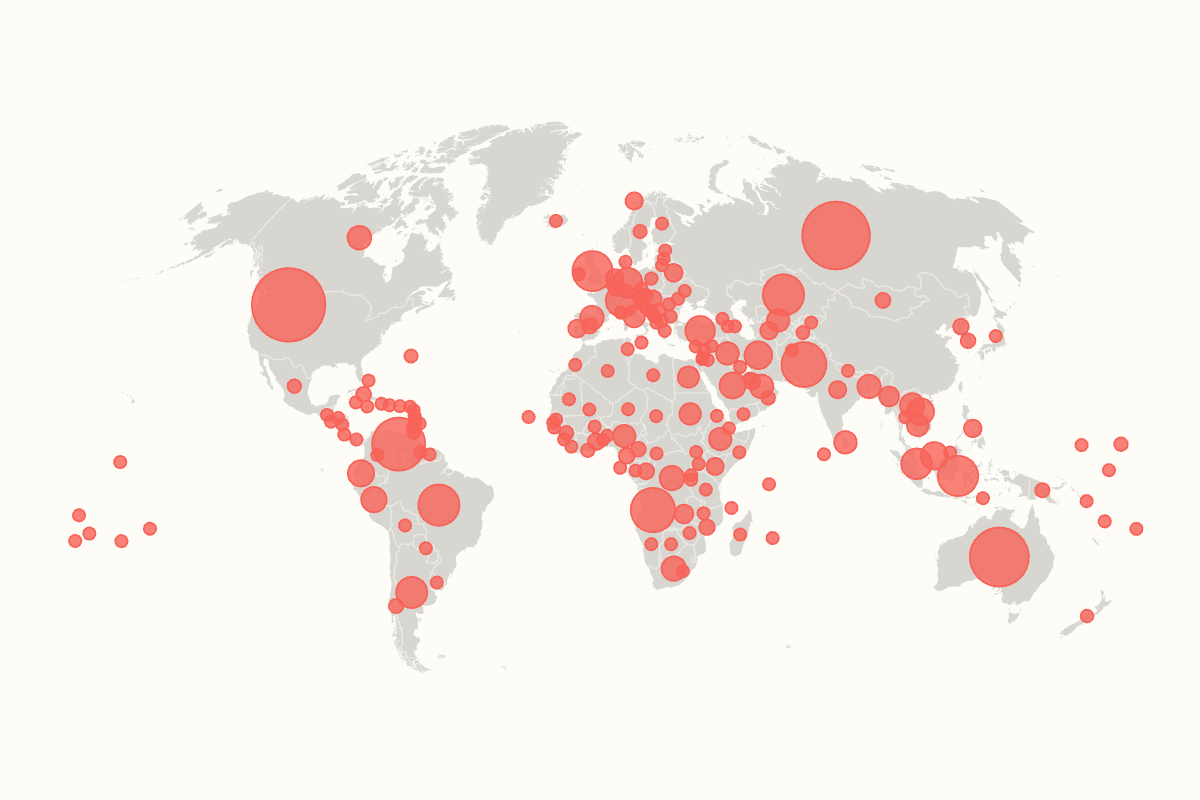

The data, compiled over three years and analyzing 30,000 projects across 217 countries, shows that China’s lending footprint is between two and four times larger than previously estimated. This revelation challenges long-held beliefs about China’s focus on developing nations, with high- and upper-middle-income countries making up a staggering 76 percent of these loans.

Among the top recipients of Chinese loans is the United States, leading the pack with $202 billion tied to 2,500 projects across the nation. Russia follows closely with $172 billion, while Australia ranks third with $130 billion. Venezuela and Pakistan round out the top five, with $105.7 billion and $75.6 billion, respectively. The United Kingdom, the sixth-largest economy, is also notably listed as the tenth largest recipient.

The implications of this report are profound. Critics have long accused China of engaging in “debt-trap diplomacy,” leveraging loans to gain control over critical infrastructure in borrowing countries. However, Chinese officials assert that their lending practices are rooted in mutually beneficial, market-driven principles. As Brad Parks, executive director of AidData, stated, “This is an extraordinary discovery given that the U.S. has spent the better part of the last decade warning other countries of the dangers of accumulating significant debt exposure to China.”

The AidData analysis was meticulously crafted, as China does not publicly disclose detailed information about its foreign lending. The research utilized an array of sources, including loan contracts, grant records, and debt restructuring agreements, ensuring a comprehensive understanding of China’s financial outreach.

This urgent update highlights the shifting dynamics of global finance, compelling other major lenders, including the United States, Germany, and Japan, to recalibrate their credit and aid strategies to remain competitive. As the authors of the report assert, China is emerging as a “new global pace-setter,” fundamentally altering how international aid and credit are administered.

The global community must now pay close attention to China’s growing influence through its extensive lending practices. The ramifications extend far beyond mere financial transactions; they touch on issues of sovereignty, infrastructure development, and international relations.

Stay tuned for more updates as this situation unfolds, and consider how these developments may affect global diplomacy and economic strategies moving forward.