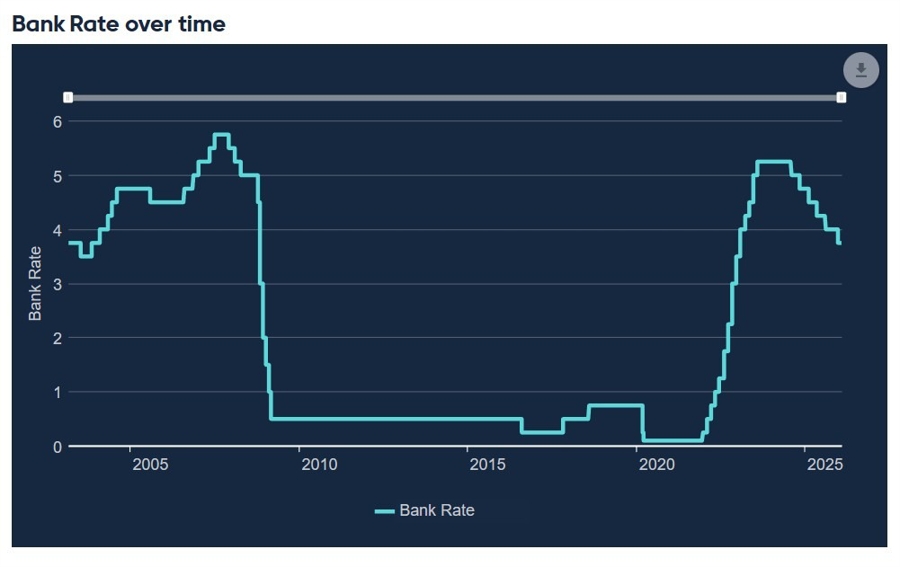

UPDATE: The Bank of England is set to announce its decision on February 5, with expectations to maintain the current interest rate at 3.75%. This significant move comes as inflation shows signs of cooling, yet persistent wage growth and other underlying pressures leave many policymakers cautious.

The decision to hold rates steady reflects a careful approach to recent economic shifts. With a rate cut implemented just before Christmas, the BoE is not rushing to further ease monetary policy. While headline inflation is projected to decrease sharply in the coming months, moving closer to the 2% target, concerns about service inflation and wage growth remain high.

As the Monetary Policy Committee meets, the focus will be on the upcoming vote split. A divided decision could indicate a growing inclination towards future rate cuts, despite the current hold. Conversely, a unanimous vote to maintain rates suggests ongoing apprehension about domestic inflation pressures, particularly within the labor market.

Market reactions reflect this uncertainty, with investors reducing expectations for near-term rate cuts. The latest market pricing indicates a low probability of easing this year, driven by domestic inflation worries and shifting global economic dynamics. Notably, the UK economy has gained momentum, complicating the outlook further.

Economists anticipate that the Bank’s updated economic forecasts will mirror previous projections, which suggested inflation would hover around the target over the medium term. Policymakers remain vigilant to external risks, including geopolitical uncertainties and changes in global financial conditions, despite recent muted market responses.

With the announcement just days away, market participants are keenly watching for any subtle shifts in the Bank’s messaging regarding wages, labor-market conditions, and financial stability. Such nuances could significantly influence expectations for future monetary policy moves.

As this critical decision approaches, the implications for consumers, businesses, and the broader economy are profound. Stakeholders are urged to stay informed as the situation develops, with the potential for significant impacts on spending, investment, and overall economic health in the UK.