The Chicago City Council has approved an alternative revenue plan that excludes Mayor Brandon Johnson‘s controversial corporate head tax. On Friday, the vote concluded with a tally of 29 to 19, falling five votes short of the veto-proof majority required to override a potential veto from the mayor. This decision follows a contentious debate, highlighting divisions within the council regarding the city’s fiscal strategy.

In the lead-up to the vote, allies of the mayor proposed a plan to reinstate the head tax, which had previously been rejected. This plan aimed to fully fund an advance pension payment and replace a $90 million debt collection strategy that Johnson has criticized as “immoral.” However, their proposal was redirected to the Rules Committee instead of being considered by the Finance Committee, which is typically responsible for such matters.

The City Council is set to reconvene on December 30, when they are expected to vote on the $16.6 billion budget for 2026. This budget will authorize the Johnson administration to borrow $1.8 billion for various capital improvement projects, including retroactive pay raises for firefighters and paramedics, and refinancing $1 billion in existing city debt at reduced interest rates.

Johnson has voiced concerns that the current budget is $165 million out of balance, which could lead to a mid-year shortfall, resulting in potential service cuts, layoffs, or tax increases. The mayor emphasized, “If I find this budget to be irresponsible and unbalanced, then it leaves me with very few options.” Johnson has consistently indicated his commitment to avoiding a government shutdown, which could have severe implications for city services and everyday citizens.

During discussions, Johnson condemned the plan to sell $1 billion in outstanding city debt to collection agencies. He shared a personal experience of having to pay overdue water and sewer bills before taking office, indicating that he is wary of the repercussions of aggressive debt collection practices. When asked if the debt collection plan was a deal-breaker for him, he responded affirmatively, stating, “I’m gonna push hard for a better way to balance this budget.”

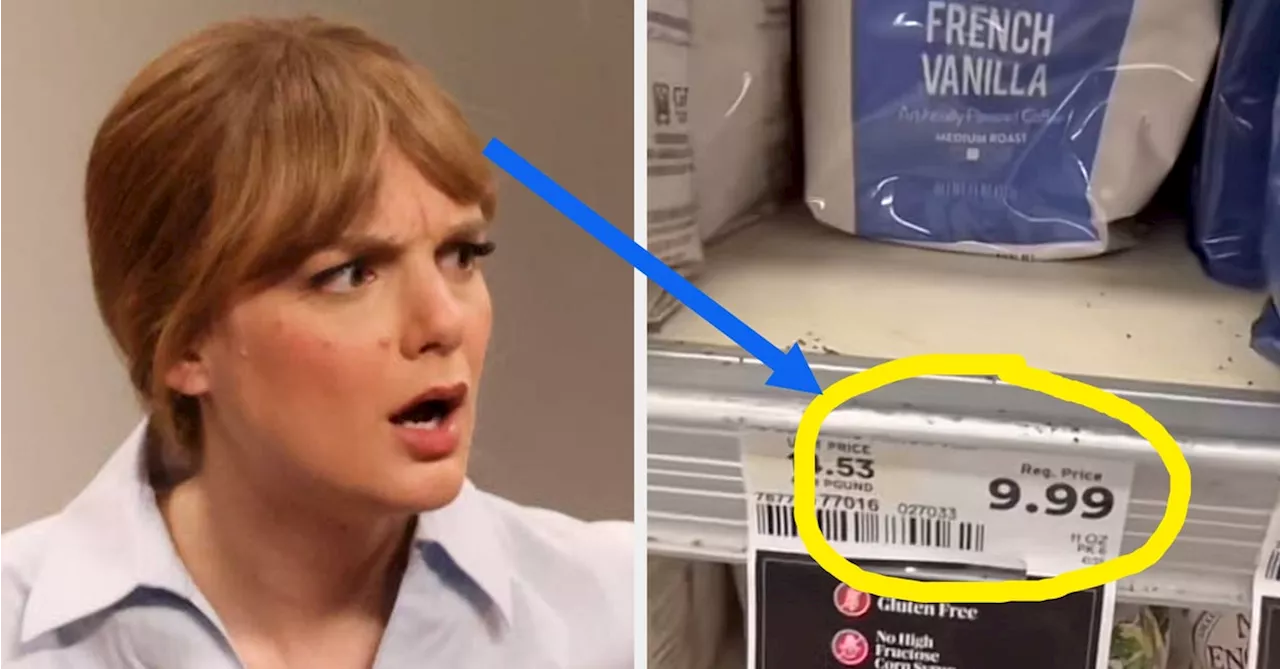

The approved revenue package incorporates several new initiatives while omitting the head tax. It includes a 15% tax on cloud computing and raises property taxes by $9 million for libraries. Additionally, it proposes an increase in the plastic bag tax by a nickel, generating $8.7 million annually, and estimates $6.8 million from licensing newly legalized video gambling terminals. A proposed liquor tax will now be 1.5%, reduced from 3%, to mitigate opposition from the hospitality sector.

The plan also envisions an expanded Downtown congestion fee zone, expected to raise $26 million, despite efforts to apply the city’s amusement tax to rideshare services being halted. The initiative to lift the ban on video gambling projects that 80% of eligible establishments will apply for licenses, contributing to projected revenues. Furthermore, the package anticipates $29.3 million from selling advertising space on city properties and vehicles.

The 15% tax on cloud computing services and equipment leases is projected to generate $416 million annually, significantly impacting businesses, which will likely pass costs onto consumers. The advanced pension payment has been restored to $260 million, funded partly through identifying $46.6 million in budget efficiencies.

During the council session, Finance Chair Pat Dowell emphasized the importance of the budget plan, stating, “We have emerged today with a budget plan that protects programs which are vital to those most in need while setting us on a right path towards a stronger fiscal future.” Dowell’s opposition to the head tax has been pivotal in the council’s decision-making process.

As the council moves forward, renegade alderpersons believe they could potentially secure additional votes if Johnson decides to veto the budget. The urgency surrounding these budget discussions has intensified, especially given Chicago’s precarious financial situation, which is now just two notches above junk status.

Chief Financial Officer Jill Jaworski was asked during a recent Budget Committee hearing whether an unbalanced budget or a government shutdown would be worse for the city’s bond rating. Without hesitation, she indicated that a shutdown would have more severe consequences. Johnson echoed this sentiment, stressing the importance of using every available tool to prevent such an outcome.

The next steps hinge on Johnson’s decision regarding the budget, with considerable implications for the city’s financial future and the services it provides to its residents.