Millions of Americans are grappling with significant increases in health insurance premiums as open enrollment for 2026 coverage begins. The expiration of expanded Affordable Care Act (ACA) subsidies, which previously capped premiums at 8.5 percent of income, is the primary driver behind this alarming trend. Around 22 million individuals benefited from these subsidies, costing approximately $35 billion annually. As these expanded subsidies come to an end, many Americans now face premium hikes that are forcing them to reconsider their health coverage options.

For example, Jeff Rowan, a retiree from Colorado, has seen his monthly premium for a health plan through the state insurance exchange leap from $350 to nearly $900. Faced with this steep increase, he opted for a plan from his pension that costs $700, still representing a 100 percent rise compared to last year. Rowan described his decision as “fear-based,” acknowledging that the threat of unforeseen medical expenses looms large over his financial situation.

In Wisconsin, small-business owner Galen Perkins shared his experience of previously skipping insurance and suffering the consequences. Now, even as his ACA premium increases by 25 percent, he plans to absorb the costs and cut back on other expenses. Perkins anticipates that many will tighten their budgets significantly, stating, “We’re just going to buy food, pay rent, pay health insurance, and that’s it.” He expressed concern that this shift could negatively impact the economy.

Elected officials are also receiving an influx of messages from constituents alarmed by the steep premium increases. Representative Seth Magaziner (D-RI) reported hearing from constituents facing staggering hikes. One retiree, currently paying $600 monthly with ACA tax credits, will see her premium soar to $2,120, a jump of 250 percent. Another small-business owner’s premiums will rise from $536 to over $1,000, an increase of 89 percent. Magaziner emphasized that “Americans cannot afford these price increases,” warning that the spikes will disrupt household budgets across the nation.

Senator Michael Bennet (D-CO) highlighted the urgency of the situation, noting that his office has received over 3,200 messages this month regarding health care costs. He stated, “Working families are already struggling to get by as the costs of childcare, rent, and groceries continue to skyrocket.” Bennet advocates for extending the ACA premium tax credits to alleviate the financial burden on families.

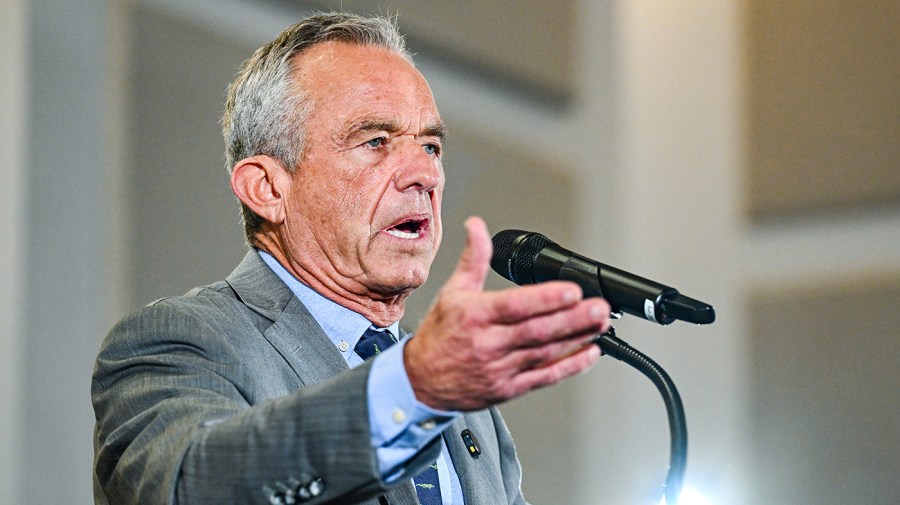

The political landscape surrounding health care is intensifying, as former President Donald Trump voiced his opinions on social media, advocating for direct financial assistance to individuals rather than funding insurance companies. He asserted that allowing people to negotiate their own insurance plans would empower them.

Republican lawmakers are reportedly considering alternative solutions, such as providing funds through flexible savings accounts or health savings accounts. Critics argue, however, that these approaches may not address the root issue, as they could simply redirect funds back to insurance companies, which hold significant negotiating power in the current system.

The end of ACA subsidies without a comprehensive plan raises concerns about the long-term viability of insurance coverage in the United States. Dr. Vikas Saini, president of the Lown Institute, warns that healthier individuals may forgo insurance altogether, leading to a risk pool comprised of sicker individuals, which in turn will increase costs for insurers. The Congressional Budget Office has projected that this trend will result in higher premiums across the board, including for those with employer-sponsored insurance.

In New York, Taylor M., who works for a health care provider, has experienced a 30 percent increase in his employer-provided insurance costs. While he finds this manageable, he notes that colleagues with families face prohibitively high total costs. Meanwhile, Sam, a resident of Portland, Oregon, has been forced to navigate the challenges of finding affordable coverage. He found that the lowest-cost ACA bronze plan would cost him around $420 monthly, leaving him with significant out-of-pocket expenses for medications and care.

As families across the nation confront the ramifications of rising health insurance costs, many are left feeling vulnerable and uncertain about their options. The political discourse surrounding health care continues to evolve, with the potential for significant policy changes that could further impact access to coverage. The urgency of addressing these issues is clear, as millions of Americans weigh their financial futures against the necessity of health insurance.