UPDATE: California consumers are pulling back on borrowing as late bill payments spike, signaling deepening economic stress in the Golden State. New data from the Federal Reserve Bank of New York reveals alarming trends that could impact financial stability for many households.

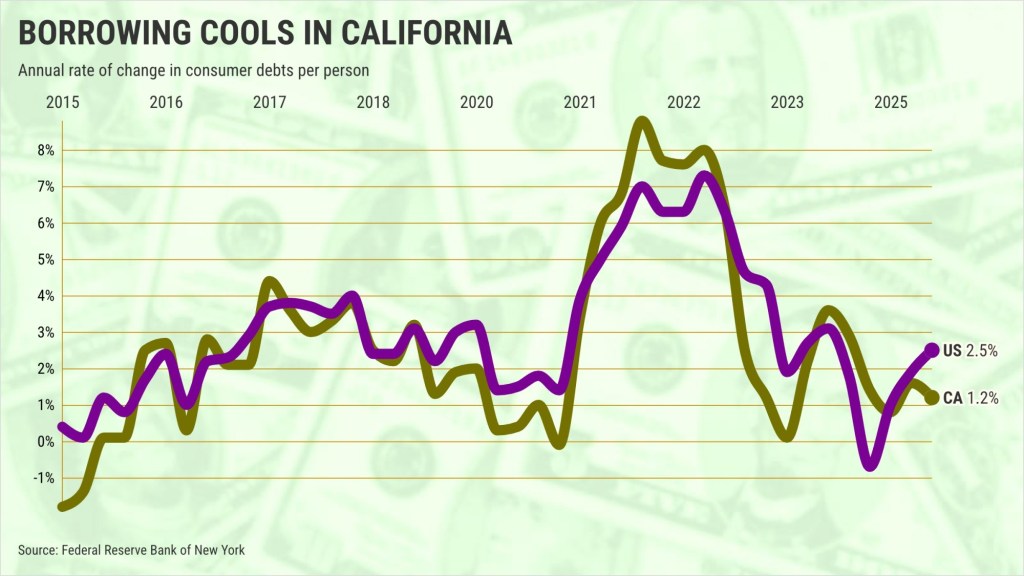

In the third quarter of September 2023, Californians averaged $87,570 in consumer debt per person, marking a modest 1.2% increase year-over-year. This uptick is notably slower than the 2.9% growth seen in the previous year, reflecting a shift in consumer behavior driven by rising financial anxieties.

The Conference Board reported a staggering 18% decline in California’s consumer confidence index over the past year, underscoring the state’s economic struggles. In stark contrast, national consumer debt rose to $63,340 per person, a 2.5% annual increase, which suggests that while many Americans are borrowing more, Californians are tightening their financial belts.

Moreover, the percentage of Californians falling behind on their bills has increased. As of the third quarter, 2.01% of consumer bills were reported as 90 days or more late, up from 1.9%. This marks the highest delinquency rate since early 2020, when the pandemic began to shake the economy. Despite this, California’s rate remains below the national average of 2.98%, which itself had just seen a decrease from 3.02% earlier this year.

Late payments are not solely a California issue; they are a growing concern nationwide. Texas reported a delinquency rate of 3.85%, while Florida faced an even higher rate at 4.1%.

A significant factor in these financial woes is the end of federal student loan payment reprieves, which has led to a surge in delinquencies. Nationwide, 14.3% of student loans are now unpaid, the highest level since records began in 2000. While California’s average student debt stands at $4,710 per person—below the national average of $5,540—the impact of missed payments is still being felt across the state.

As Californians navigate this challenging economic landscape, they are being forced to make tough choices about spending and borrowing. With consumer confidence dwindling and bill payment issues escalating, the financial outlook for many residents remains uncertain.

What’s Next: As Californians grapple with these financial pressures, experts urge vigilance and awareness of emerging trends. Consumers are encouraged to reassess their budgets and borrowing strategies in light of these developments.

Stay tuned for more updates on California’s economic condition and its implications for residents. The situation is evolving rapidly, and understanding these trends is crucial for navigating the months ahead.