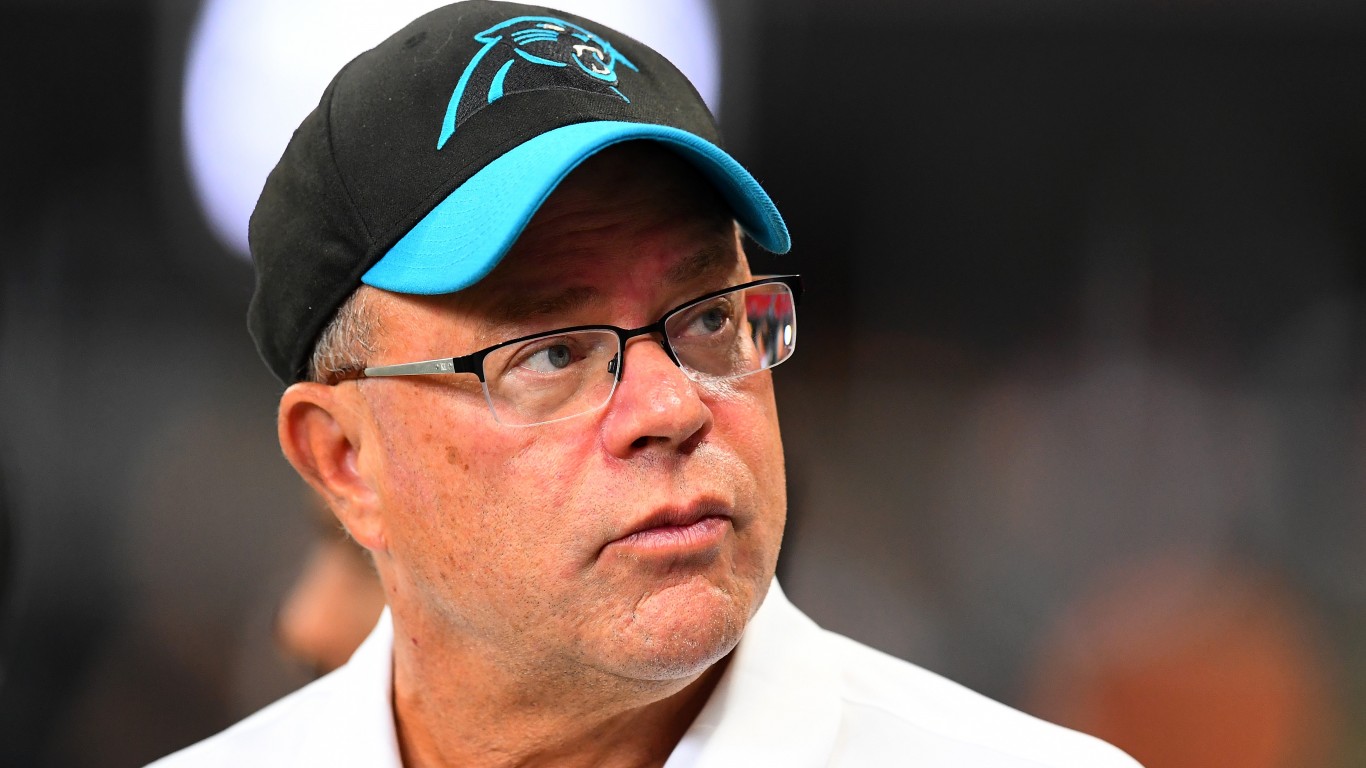

Hedge fund manager David Tepper has made significant adjustments to his investment portfolio, with 37% of his fund now concentrated in four prominent stocks. Tepper, the founder of Appaloosa Management, has shifted his focus towards large-cap technology companies, which are expected to benefit from the ongoing advancements in artificial intelligence (AI). This strategic positioning reflects Tepper’s belief in the long-term potential of these stocks.

Appaloosa has notably reduced its stake in Broadcom Inc. while increasing its investment in UnitedHealth Group. Furthermore, Tepper has decreased his holdings in semiconductor giants such as Nvidia, opting instead to boost exposure to Chinese equities, particularly Alibaba. He has publicly stated his intention not to “fight the Fed,” acknowledging the challenges presented by current market conditions.

Top Holdings in Tepper’s Portfolio

Currently, Alibaba represents the largest holding in Tepper’s portfolio, accounting for just over 12%. The stock has experienced a resurgence, attributed in part to recent news regarding China’s stimulus plans. While the stock has surged more than 50% year-to-date, it remains 63% below its peak, presenting a potential value opportunity for investors like Tepper, who seek deep-value investments.

In second place is Amazon, which constitutes 10.9% of the fund. Recently, Amazon unveiled impressive AI innovations, including a fully autonomous supply chain. Analysts, including those from Morgan Stanley, suggest that Amazon could streamline operations significantly, potentially eliminating around 14,000 managerial positions to save $3 billion. The company’s advancements in AI are expected to play a crucial role in driving future growth.

Other Notable Investments

Third on Tepper’s list is Microsoft, making up 8.6% of the portfolio. As a leader in enterprise technology, Microsoft is heavily invested in AI and has a significant stake in OpenAI. Many analysts believe that Microsoft’s focus on AI positions it well to lead in the future of technology. Although Tepper has slightly reduced his investment in Microsoft, he may consider increasing his stake again should prices dip.

The fourth largest holding is Meta Platforms, which comprises 7.6% of the fund. Following a recent surge in stock price, Meta is exploring innovative technologies aimed at the metaverse. With its new smart glasses, the company is poised to capture consumer interest in the evolving tech landscape. Despite missing out on a 90% gain over the past year, investors are encouraged to look ahead, as Meta continues to develop growth drivers.

In summary, Tepper’s strategic adjustments in his investment portfolio reflect a focused approach on large-cap technology stocks that are expected to thrive amid the technological revolution. With a solid foundation in AI and related innovations, Appaloosa Management is well-positioned for potential future success in the market.