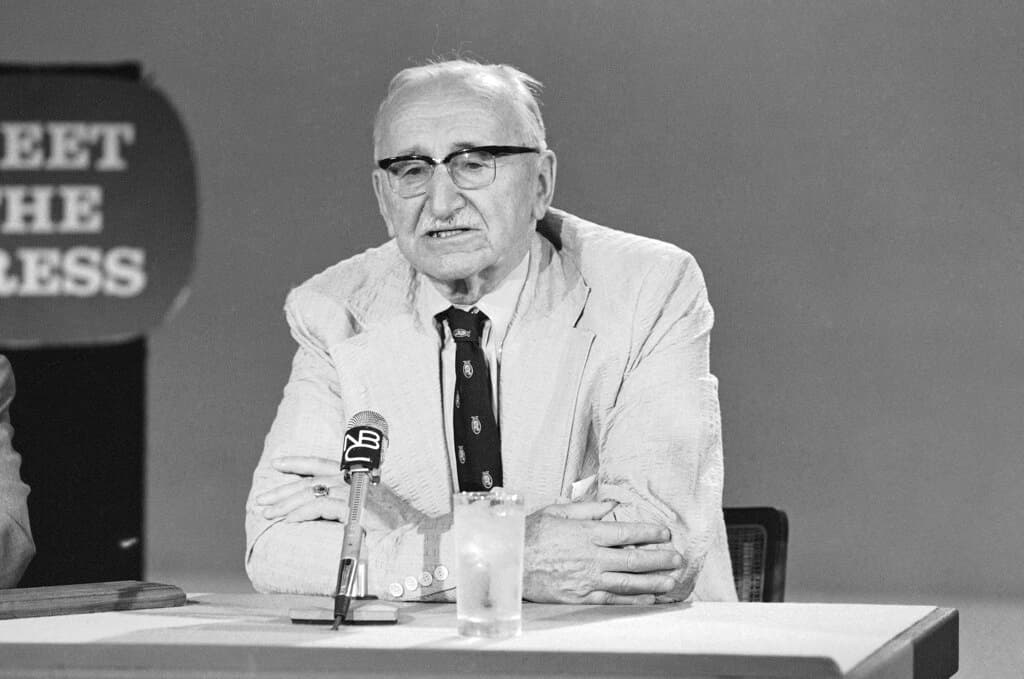

URGENT UPDATE: In a striking turn of events, central banks worldwide are increasingly pivoting towards gold, rediscovering its value as a reserve asset. This shift comes as concerns mount over the long-term viability of fiat currencies, a trend first highlighted by economist Friedrich Hayek in his seminal essay “Choice in Currency.”

Since 1971, the U.S. government has relied on a fiat monetary system, enabling politicians to print money without restraint to finance growing deficits. This practice has led to significant currency depreciation, eroding the purchasing power of citizens and diminishing their savings. Hayek, in his analysis, warned that governments often misuse their control over currency, leading to financial instability for the public.

New reports confirm that many central banks are now actively increasing their gold reserves. This shift is particularly notable given the previous skepticism towards gold, as recently articulated by Harry Dexter White during the Bretton Woods Conference in 1944, when he asserted that the U.S. dollar and gold were synonymous. Fast forward to today, and the dollar has depreciated by an astonishing 99 percent against gold, now valued at about one-quarter of an ounce per $1,000.

The market dynamics are changing. Central banks, once dismissive of gold, are now recognizing its potential as a hedge against inflation and currency instability. The unrealized profit of the U.S. Treasury on its gold reserves has surged to approximately $1 trillion, while the Federal Reserve finds itself in a precarious position with a total loss nearing $1 trillion when accounting for both operational and market losses.

This evolving landscape reflects Hayek’s vision of competition among currencies. As central banks explore alternatives to fiat currency, gold is making a significant comeback. The shift may redefine how nations approach monetary policy, emphasizing the need for stability and trust in their financial systems.

The implications of this trend extend beyond financial markets. As citizens witness their purchasing power diminish, the debate surrounding currency choice intensifies. People are increasingly interested in securing their wealth through more stable assets like gold.

Looking ahead, observers will closely monitor central bank strategies regarding gold reserves and the broader implications for global currency markets. The conversation about monetary reform and currency choice is gaining momentum, with gold reasserting itself as a key player.

For those following these developments, the question remains: Will governments adapt their monetary policies to foster a competitive currency environment, or will they continue to rely on their fiat monopolies? As this story unfolds, the urgency of these decisions will impact economies worldwide.