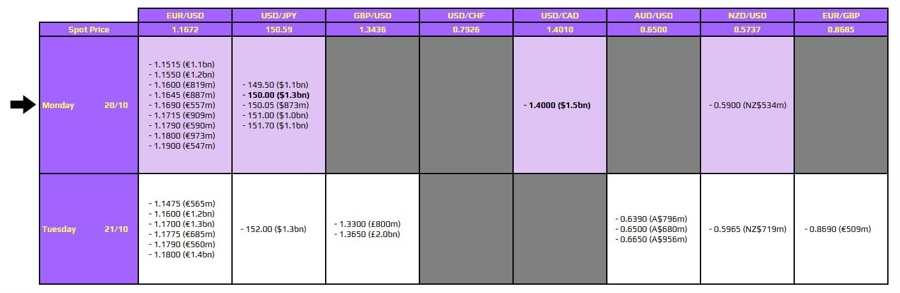

URGENT UPDATE: FX option expiries are set for October 20, 2023, at 10 AM New York time, with critical movements anticipated in major currency pairs. Traders should take immediate note of key levels for USD/JPY and USD/CAD, as developments in Japanese politics add volatility to the market.

The USD/JPY is currently hovering near the 150.00 mark, having broken below this level on Friday. As the week begins, political developments in Japan are influencing its trajectory. The ruling LDP (Liberal Democratic Party) is expected to form a coalition with Nippon Ishin, potentially leading to Takaichi stepping into the role of prime minister. While the end of political uncertainty is generally positive for the yen, Takaichi’s fiscal dove stance raises concerns about future monetary policies.

As these expiries approach, they may act as a buffer against significant price declines. Upside movements could be limited around the 151.00 mark, where the 100-hour moving average is positioned, adding another layer of complexity to trading decisions.

Additionally, there is a key expiry for USD/CAD at the 1.4000 level. Although this does not tie to any major technical significance, it could temporarily restrict downward movement in the pair after a recent drift lower since late last week. Traders should remain vigilant, as this expiry will roll off later today.

Market participants are urged to pay close attention to these developments, as they can significantly impact trading strategies and market movements. For those looking to stay informed, further insights can be found on investingLive (formerly ForexLive), your go-to source for real-time trading information.

As the clock ticks down to these expiries, the urgency to act on this information cannot be overstated. Keep a close eye on the market, and prepare for potential volatility as these key levels approach.