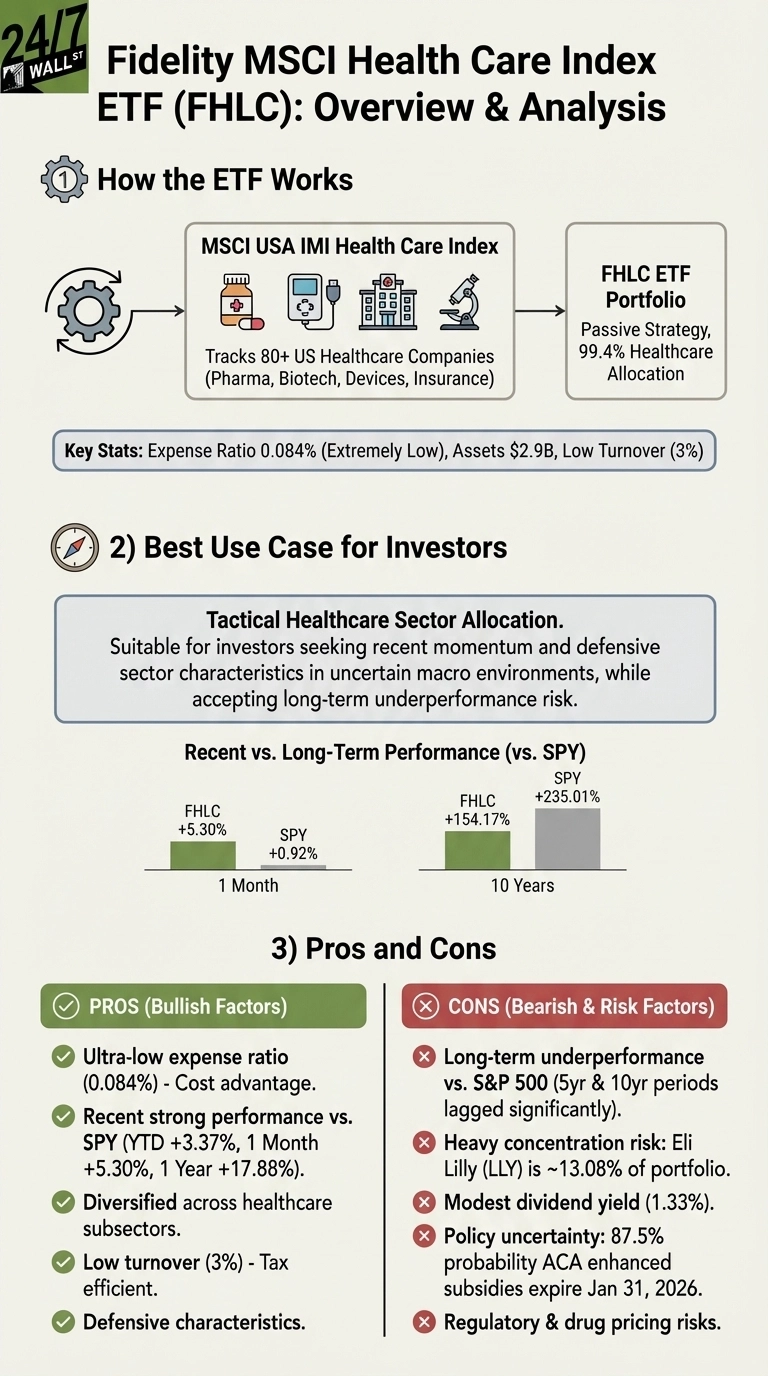

Investors are evaluating the Fidelity MSCI Health Care Index ETF (FHLC) as it presents a low-cost entry point into the healthcare sector. Despite an impressive short-term return of 17.9% over the past year, concerns about concentration risk and long-term performance have emerged. The fund, which charges an expense ratio of just 0.084%, has a notable reliance on a single stock, Eli Lilly, which comprises over 13% of its portfolio.

The FHLC tracks the MSCI USA IMI Health Care Index, offering exposure to a range of U.S. healthcare companies in pharmaceuticals, biotechnology, medical devices, and health insurance. With more than 80 holdings, the ETF aims to provide investors with capital appreciation and modest dividend income from established healthcare firms. However, its performance is increasingly tied to Eli Lilly’s success, particularly with the company’s GLP-1 obesity drugs, which have seen a 46% increase in stock price over the past year.

Recent performance data reveals that while FHLC has outperformed the S&P 500 in the short term, it has fallen short over longer periods. In the past five years, the fund returned 42.6% compared to the S&P 500’s 84.5%. Over ten years, the gap widens further, with FHLC achieving 154% against the S&P 500’s 235%. This disparity highlights ongoing challenges in the healthcare sector, including drug pricing pressures and slower innovation cycles outside of oncology and rare diseases.

“Healthcare investors must accept political and regulatory uncertainty,”

stated an industry analyst, reflecting on the potential implications of upcoming policy changes. Prediction markets currently indicate an 87.5% likelihood that enhanced Affordable Care Act (ACA) premium tax credits will expire by the end of January 2026. This could create significant pressure on health insurers such as UnitedHealth, which has already experienced a 31% decline in stock price over the past year.

Income-oriented investors may find FHLC’s current yield of 1.33% less appealing compared to alternatives in the broader market. Although the fund has grown dividends at approximately 4.6% annually over the last five years, this rate barely keeps pace with inflation and lags behind other defensive sectors.

For those seeking maximum capital appreciation, FHLC may not be the ideal choice. The healthcare sector’s historical underperformance compared to the broader market makes it less suitable for aggressive portfolios. Additionally, retirees prioritizing income generation might achieve better yields in other sectors without sacrificing stability.

Investors looking for alternatives might consider the Vanguard Health Care ETF (VHT), which charges a slightly higher expense ratio of 0.09% but manages $20.4 billion in assets, compared to FHLC’s $2.9 billion. VHT offers a higher dividend yield of 1.38% and has a longer track record, providing increased liquidity and tighter bid-ask spreads.

In summary, while the Fidelity MSCI Health Care Index ETF may serve as a tactical allocation for investors seeking low-cost exposure to the healthcare sector, the concentration risk and historical underperformance warrant careful consideration. Those interested in navigating the complexities of healthcare investing should weigh these factors against their individual investment strategies.