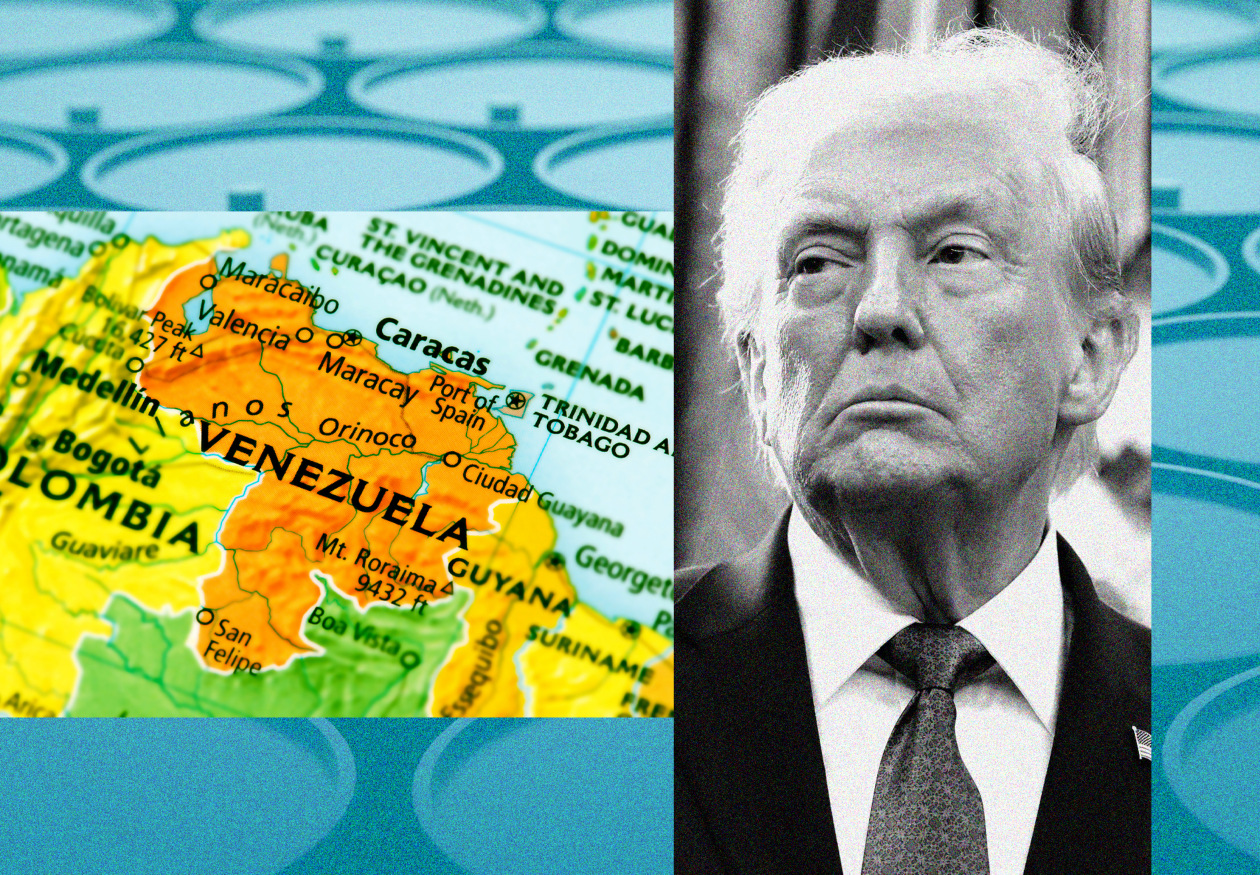

UPDATE: President Donald Trump is set to meet with top oil executives today, March 21, 2024, to discuss potential investments in Venezuela, a meeting that could facilitate up to $10 billion in new U.S. energy opportunities. This urgent gathering follows the U.S. capture of Venezuelan President Nicolás Maduro, marking a significant shift in U.S.-Venezuela relations.

The high-stakes meeting includes executives from major industry players such as Exxon Mobil, Chevron, and ConocoPhillips, all keen to explore investment avenues in the oil-rich South American nation. The discussions are expected to address the complex landscape of energy production in Venezuela, which has been marred by political strife and economic instability.

This development is critical for investors, as it signals a potential reopening of Venezuela’s lucrative oil sector, which has been largely inaccessible due to sanctions and government turmoil. The implications of this meeting could reverberate through global markets, particularly affecting oil prices and investment strategies in the energy sector.

As the meeting unfolds, many questions remain unanswered, particularly regarding the regulatory framework and the risks involved in investing in a country with a fraught political environment. Investors are advised to stay alert for announcements that could shape the future of energy investments in Venezuela.

The urgency of this meeting cannot be overstated. With the U.S. poised to redefine its relationship with Venezuela, the outcomes could not only impact the oil market but also affect geopolitical dynamics in the region. Observers are eager to see how this pivotal moment could influence future energy policy and investment flows.

What’s Next: Watch for immediate updates from the meeting as details emerge. The energy sector is on high alert, and the potential for significant U.S. investment in Venezuela could reshape the market landscape dramatically. Share this news to keep others informed about these critical developments.