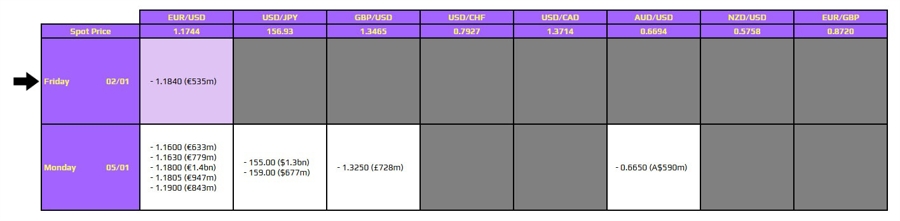

The foreign exchange market is experiencing a quiet start to the year, with limited activity and interest as traders return from the holiday break. Today, January 2, 2024, marks a significant moment with the expiration of FX options at 10:00 AM New York time. However, the anticipated market movement may be muted, given that many participants remain absent from the trading floor.

As the market shifts out of the holiday lull, major expiries are notably sparse. The calm trading environment reflects a broader trend, where liquidity is expected to gradually improve as the week progresses. According to analysts, positioning flows for major currencies will be crucial in shaping market dynamics in the early days of 2024.

Focus on Precious Metals

Despite the subdued activity in the foreign exchange market, there is heightened interest in precious metals. Gold prices have risen by 1.5% to reach $4,378, while silver has seen a more substantial increase of 3.9%, currently trading around $74.05. This rally in precious metals is capturing the attention of investors and traders alike, adding a layer of excitement to an otherwise quiet market.

As the week unfolds, traders are urged to keep an eye on developments in both the FX market and the precious metals sector. The early positioning and trading strategies adopted now may set the tone for the upcoming weeks.

For those looking to capitalize on this information and stay informed about market trends, resources such as investingLive provide valuable insights and updates. As 2024 gets underway, traders and investors will be keenly aware of how these initial movements may influence their strategies as they navigate the evolving financial landscape.