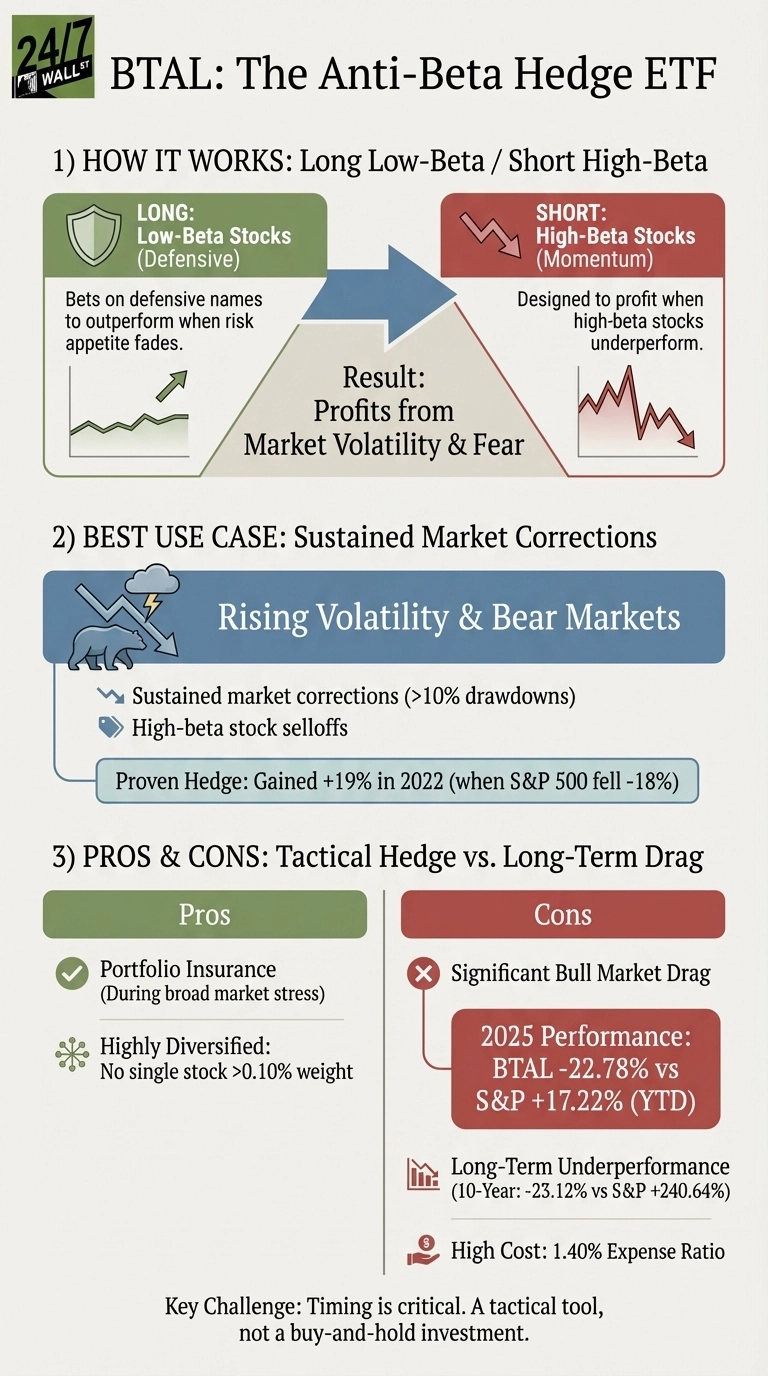

Investors are questioning the relevance of anti-beta exchange-traded funds (ETFs) such as the AGFiQ U.S. Market Neutral Anti-Beta Fund (NYSEARCA:BTAL) as they plan for 2026. The fund aims to provide an alternative strategy during periods of market volatility by investing in low-beta stocks while shorting high-beta stocks. However, its recent performance has raised concerns about whether it remains a worthwhile component of an investment portfolio.

In 2022, BTAL delivered a notable return of 19% when the S&P 500 fell by 18%. This success demonstrated the fund’s potential to act as a protective measure during market downturns. Yet, the situation changed drastically in 2025, when BTAL lost 22.8% while the S&P 500 gained 17.2%. This 40-percentage-point gap underscores a critical limitation of the fund: it tends to underperform during bullish market conditions.

Over the past decade, BTAL has experienced a decline of 23%, contrasting sharply with the S&P 500’s impressive 241% increase. This translates to an opportunity cost of 264 percentage points for investors holding onto BTAL during robust market periods. The fund’s high expense ratio of 1.40% further complicates its appeal, especially in a landscape where investors are increasingly seeking cost-effective options.

Understanding BTAL’s Strategy and Market Dynamics

BTAL’s strategy revolves around capitalizing on the performance discrepancies between low-beta and high-beta stocks. It is designed to provide portfolio insurance during broad market stress. As a highly diversified fund, it limits exposure to individual stocks, ensuring no single stock comprises more than 0.10% of its portfolio. This diversification aims to mitigate risk when market conditions are unfavorable.

Despite its potential benefits, BTAL’s performance in recent years raises significant concerns. The year 2025 was particularly challenging for this fund, which highlights its reliance on market conditions to perform effectively. The fund’s strategy is intended for tactical use rather than as a long-term buy-and-hold investment, making timing an essential factor for prospective investors.

Looking forward to 2026, various market outlooks present differing perspectives. Vanguard forecasts mid-single-digit returns, while BlackRock expects U.S. equities to outperform their global counterparts. On the other hand, JP Morgan anticipates slower growth but no recession. Given these projections, investors must consider their outlook on market performance for the coming year.

Making a Decision: Should You Hold BTAL?

The question of whether to hold BTAL in 2026 ultimately hinges on individual investor sentiment regarding market conditions. If investors believe there is a reasonable probability—say, 20% or greater—that the S&P 500 could experience a down year, then BTAL may serve as a valuable hedge against volatility.

Conversely, if the prevailing sentiment aligns with optimistic forecasts suggesting continued growth, BTAL may represent a drag on overall portfolio performance. Despite its recent struggles, some analysts still advocate for retaining BTAL as a strategic insurance policy, particularly for those concerned about potential downturns.

In conclusion, evaluating the worth of anti-beta ETFs like BTAL requires a comprehensive understanding of market trends and individual risk tolerance. As 2026 approaches, investors must carefully weigh their options, considering both the historical performance of BTAL and the broader economic indicators that could influence market dynamics.