Signal Advisors Wealth LLC has increased its holdings in Microsoft Corporation (NASDAQ: MSFT) by 27.7% during the third quarter of 2023. According to the company’s latest Form 13F filing with the Securities and Exchange Commission (SEC), Signal Advisors now owns 46,941 shares of Microsoft, having acquired an additional 10,168 shares during this period. This investment represents 2.2% of Signal Advisors’ total portfolio, making Microsoft its eighth-largest holding, valued at approximately $24,313,000.

Other institutional investors have also adjusted their positions in Microsoft. For instance, AlphaQuest LLC increased its stake by 5.9% during the second quarter, bringing its total to 342 shares worth $170,000. Similarly, PMV Capital Advisers LLC raised its holdings by 5.9%, now owning 359 shares valued at $178,000. Notably, Seek First Inc. boosted its position by 1.5%, holding 1,358 shares worth $675,000.

Microsoft Stock Performance and Dividends

As of the latest trading session, Microsoft shares opened at $487.61. Over the past year, the stock has fluctuated between a low of $344.79 and a high of $555.45. Microsoft’s market capitalization stands at $3.62 trillion, with a price-to-earnings ratio of 34.68. The company also recently announced a quarterly dividend of $0.91, set to be paid on March 12, 2024, to shareholders recorded by February 19, 2024. This dividend translates to an annualized payout of $3.64 and a yield of 0.7%.

Insider Transactions and Analyst Ratings

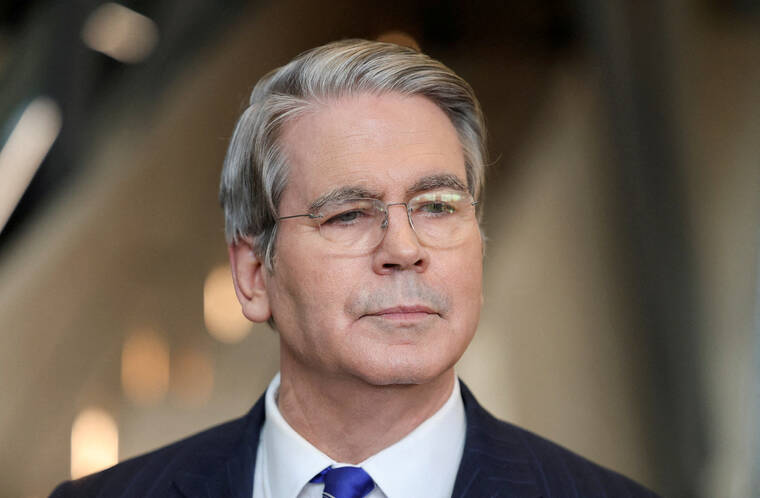

In related news, insider Bradford L. Smith sold 38,500 shares on November 3, 2023, at an average price of $518.64, totaling $19,967,640. Following this transaction, Smith retains 461,597 shares, valued at approximately $239,402,668. Additionally, Takeshi Numoto, Executive Vice President, sold 2,850 shares on December 4, 2023, for $1,364,352.

Over the last three months, insiders have sold a total of 54,100 shares, valued at $27,598,872, indicating a slight decrease in their ownership, which now stands at 0.03% of the company.

Wall Street analysts have expressed optimism regarding Microsoft’s future. Baird R W upgraded the stock to a “strong-buy” rating on November 14, 2023, while The Goldman Sachs Group has reaffirmed a “buy” rating with a target price of $630.00. Overall, Microsoft holds an average rating of “Moderate Buy” with a consensus target price of $631.03, according to data from MarketBeat.com.

Microsoft Corporation, headquartered in Redmond, Washington, is a leading global technology company founded in 1975 by Bill Gates and Paul Allen. The company develops a wide range of software products, services, and devices aimed at consumers, enterprises, and governments worldwide. Its renowned product lineup includes the Windows operating system and the Microsoft 365 suite of productivity tools.