UPDATE: Tokyo’s consumer price index (CPI) has just reported a decrease, easing to 2.3% year-on-year in December 2023, yet remaining significantly above the Bank of Japan’s (BOJ) 2% target. This development, announced today, signals a complex landscape for monetary policy as the BOJ prepares for ongoing gradual rate hikes.

In a notable shift, core consumer prices in the capital fell from 2.8% in November, surprising many analysts who had expected a rise to 2.5%. The slowdown is primarily attributed to a reduction in utility and energy costs, alongside moderated food price increases. A closely monitored “core-core” measure, stripping out both fresh food and energy, also softened to 2.6%, down from 2.8% previously.

This decline marks the first significant easing in Tokyo’s inflation momentum since August 2023, providing a glimmer of relief. However, all three metrics remain above the BOJ’s inflation target, indicating that underlying price pressures persist. Tokyo’s CPI is widely viewed as a leading indicator for national inflation trends, suggesting a gradual cooling rather than a sharp decline.

The latest figures follow the BOJ’s decision last week to raise its policy rate to 0.75%, the highest level in nearly three decades. Governor Kazuo Ueda emphasized that further tightening is likely if wages and prices align with the central bank’s expectations. However, he has refrained from providing specific guidance on the pace or terminal levels of future hikes.

Market reactions to the December data indicate a consensus that inflation is easing, primarily due to fading energy effects. Still, prices remain robust enough to justify potential rate hikes in the future. Analysts anticipate a gradual hiking cycle, projecting that rates may rise approximately every six months, with a possible terminal level near 1.25% if wage growth remains steady.

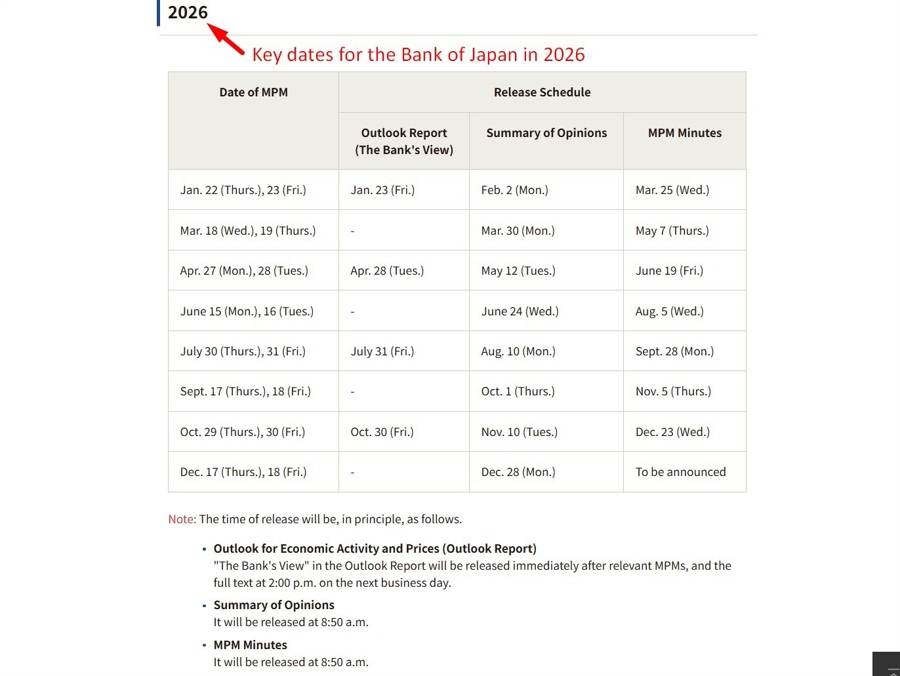

The softer-than-expected core inflation data reduces immediate pressure for another rate hike but does not alter the overall tightening trajectory. With core inflation still above the BOJ’s target and supportive wage dynamics, a cautious approach is likely. A pause in rate adjustments seems probable at the next BOJ meeting, scheduled for January 22-23, 2026.

Investors are closely monitoring the impacts of these developments on the Japanese yen, Japanese government bonds (JGBs), and the Nikkei index. The intertwined nature of inflation and monetary policy continues to shape financial markets as officials navigate this complex economic landscape.

Stay tuned for further updates as the situation develops.